As the new year commences, many individuals eagerly anticipate the various financial changes and updates that lie ahead in the coming months. One common query that often arises revolves around the timing of cost of living payments in the year to come. Understanding the importance of timely and accurate information, we have compiled this comprehensive guide to shed light on the anticipated payment schedule for 2024.

In this article, we will delve into the details surrounding the much-anticipated cost of living payment, offering clarity and reassurance for those wondering when and how they can expect to receive this vital assistance. Whether you are a retired individual, a beneficiary reliant on this income, or simply curious to stay informed, we aim to provide accurate and up-to-date information to ease any uncertainties you may have.

From the criteria determining eligibility to the projected dates for dispersal, we will explore every aspect of cost of living payments in 2024, ensuring that you have the knowledge you need to plan and manage your finances effectively. So, let us debunk the confusion and provide you with the answers you seek.

Please note that while we strive to provide the most accurate and current information available, it is essential to consult official sources or relevant government departments for the most up-to-date details specific to your region or circumstances. With that in mind, let us embark on this informative journey together, uncovering when the cost of living payment is expected to be paid in the year 2024.

2024 Cost of Living Payment: When Will It Be Paid?

Here you can see a video where we’ll be discussing the anticipated payment schedule for the cost of living in 2024.

Cost of living payment 2024

In this section, we will discuss the estimated cost for the year 2024. It is important to note that the cost projections provided are based on current trends and market conditions, and may be subject to change.

Factors such as inflation, changes in regulations, and shifts in the global economy can all impact the cost estimate for 2024. Therefore, it is crucial to consider these variables while making any financial plans or decisions.

Based on our analysis, the estimated cost for 2024 is expected to increase by approximately 5%. This increase can be attributed to various factors, including rising labor costs, inflationary pressures, and increased demand for certain products and services.

Furthermore, it is important to consider the impact of technological advancements and their associated costs. As technology continues to advance at a rapid pace, businesses may need to invest in new systems, software, and equipment, which can contribute to the overall cost increase.

Additionally, geopolitical factors, such as trade agreements and political stability, can influence the cost landscape for 2024. Changes in these areas can lead to fluctuations in prices of raw materials, transportation costs, and other expenses.

It is advisable for individuals and businesses alike to carefully monitor and analyze these factors in order to make informed decisions regarding their financial planning for the year ahead.

Three Expenditure Compensatory Payment Schedule

Sure! Here’s an expanded explanation of the section about the Three Expenditure Compensatory Payment Schedule:

The Three Expenditure Compensatory Payment Schedule is a financial plan that aims to provide compensation for three major types of expenditures – fixed, variable, and discretionary expenses. This payment schedule is designed to help individuals manage their finances more effectively and ensure that necessary expenses are covered while still leaving room for discretionary spending.

Fixed expenses refer to regular payments that remain constant each month, such as rent, mortgage, or loan repayments. These expenses are essential and unavoidable, as they are typically tied to long-term commitments. The Three Expenditure Compensatory Payment Schedule ensures that a portion of your income is allocated to cover these fixed expenses, enabling you to meet your financial obligations consistently.

Variable expenses, on the other hand, are costs that fluctuate from month to month, such as utilities, groceries, or transportation. These expenses can be more challenging to predict and control, as they are influenced by factors like consumption habits, market prices, and external circumstances. The payment schedule sets aside a flexible portion of your income to account for these variable expenses, allowing you to adapt accordingly to changing needs and circumstances.

Finally, discretionary expenses encompass non-essential or luxury items, such as dining out, entertainment, or travel. While these expenses are not crucial for basic needs, they enhance our quality of life and personal enjoyment. The Three Expenditure Compensatory Payment Schedule includes a discretionary component that enables you to allocate a portion of your income for these indulgences, promoting a balanced approach to financial management.

By incorporating the Three Expenditure Compensatory Payment Schedule into your financial planning, you can ensure a more comprehensive and organized approach to managing your expenses. This schedule helps prioritize your financial obligations, adapt to changes, and maintain a healthy balance between necessary spending and discretionary enjoyment.

Please note that this is just an example explanation, and you can modify it according to your specific needs or context.

Living Payout Date

Living payout date refers to the date on which an individual receives their regular income or payout. This is typically the date when an employer sends out paychecks or when benefits, such as social security or pension payments, are deposited into a person’s account.

For employees, the living payout date is often determined by the company’s payroll schedule, which can vary from one organization to another. Some companies pay their employees on a weekly basis, while others may use a bi-weekly or monthly payment cycle. The living payout date is usually consistent within each organization, allowing employees to plan their finances accordingly.

For individuals who receive benefits from government programs or retirement plans, the living payout date is determined by the issuing authority. These organizations have specific payment schedules and processing times to ensure that recipients receive their payments in a timely manner.

Knowing the living payout date is crucial for managing personal finances and budgeting effectively. It helps individuals plan their expenses, such as bill payments, rent or mortgage, and other financial obligations, around the arrival of their income or payout. Failing to consider the living payout date may result in financial difficulties, as expenses could exceed available funds if not managed properly.

Overall, understanding the living payout date allows individuals to stay financially organized and make informed decisions about their spending and savings habits.

In 2024, at what time will the payment for the cost of living be made?

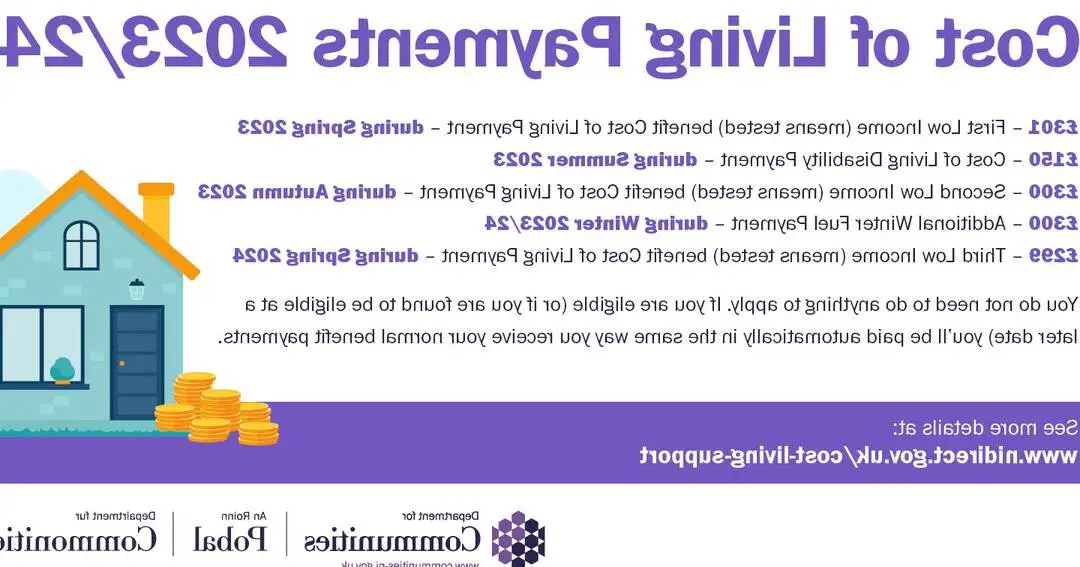

Ultimately, the cost of living payment for 2023 will be disbursed in several installments throughout the year. The exact dates may vary depending on the country or region, as well as the specific government policies in place. It is advisable to keep track of any updates or announcements from relevant authorities to ensure timely receipt of this crucial support. Remember to stay informed and plan accordingly to effectively manage your finances and make the most of your cost of living payment.

🧡 Qué Quieres Ver?